Sci/tech

Roche's new bispecific monoclonal antibody to treat vision loss in India

New Delhi, March 5 (IANS) Roche Pharma on Tuesday announced its foray into ophthalmology sector in India with a new bispecific monoclonal antibody (mAB) to treat vision loss.

Vabysmo (faricimab) may help in the treatment of neovascular or “wet” age-related macular degeneration (nAMD) and diabetic macular edema (DME) — the two leading causes of vision loss worldwide, said the company in a statement.

The world’s first bispecific mAB works by neutralising two key proteins — angiopoietin-2 (Ang-2) and vascular endothelial growth factor-A (VEGF-A) — known for the onset and progression of retinal conditions.

The proteins destabilise blood vessels in the eye, leading to inflammation and vision loss. Vabysmo may help block both pathways involving Ang-2 and VEGF-A and stabilise blood vessels.

“We believe more should be done to meet the needs of people living with retinal conditions and to preserve sight. While there is strong awareness and action for cataract and other frontal eye-disorders, retinal conditions are often diagnosed late or neglected, leading to vision loss,” said V Simpson Emmanuel, CEO and Managing Director, Roche Pharma India.

“The launch of Vabysmo marks our entry into the ophthalmology space in India, underscoring our commitment to bring the best-in-class innovations to the country. With fewer eye injections over time, while also improving and maintaining vision and anatomy, Vabysmo offers a more convenient and effective treatment schedule for patients, their caregivers and healthcare systems,” he added.

Currently available treatment options for nAMD and DME require frequent eye injections (typically every one to two months). With Vabysmo patients require eye injections at intervals of up to once in four months.

Vabysmo was first approved by the USFDA in January 2022, and is currently available in more than 90 countries.

–IANS

rvt/uk

Sci/tech

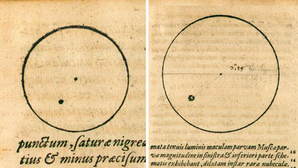

Kepler’s 400 years-old sunspot drawings decoding solar mysteries

New Delhi, July 26 (IANS) Researchers have re-examined the legendary astronomer Johannes Kepler’s sunspot drawings using modern techniques, revealing previously hidden information about solar cycles before the grand solar minimum, showing he still has not lost any of his relevance.

By recreating the conditions of Kepler’s observations and applying Sporer’s law with modern statistics, an international group led by Nagoya University in Japan has placed Kepler’s sunspot group at the tail-end of the solar cycle preceding the one observed by early telescopic astronomers like Thomas Harriot and Galileo Galilei.

Their findings, published in Astrophysical Journal Letters, offer key insights into the duration of solar cycles at the beginning of the 17th century, associated with the transition to the Maunder Minimum (1645-1715), a period of abnormally low sunspot activity.

Kepler’s observations, made with a camera obscura, recorded a sunspot group in May 1607, initially mistaken for a transit of Mercury.

Nagoya University’s Hisashi Hayakawa emphasised the significance of Kepler’s sketch, noting it as the oldest sunspot record made with instrumental observation.

By analysing Kepler’s records and comparing them with contemporaneous data, the researchers identified the sunspot group as being at the end of solar cycle -13, contrasting with later observations showing sunspots at higher latitudes. This analysis supports the regular duration of solar cycle -13, challenging other reconstructions suggesting an extremely long cycle.

The study highlights Kepler’s legacy in astronomy, showing his sunspot records predate existing telescopic records by several years, providing valuable context for understanding changes in solar behaviour during a pivotal period.

Sabrina Bechet from the Royal Observatory of Belgium noted the continued relevance of historical figures’ records in modern scientific research, underscoring Kepler’s lasting impact on the field.

–IANS

ts/rvt/vd

Sci/tech

India’s Forex reserves surge to lifetime high of $670.86 bn

Mumbai, July 26 (IANS) India’s foreign exchange (Forex) reserves rose for the third-consecutive week to touch a new lifetime high of $670.86 billion as of July 19, according to the latest data released by the RBI on Friday.

The reserves surged by $4 billion during the week after increasing by a cumulative of $14.9 billion in the preceding two weeks.

An increase in the Forex reserves reflects strong fundamentals of the economy and gives the RBI more headroom to stabilise the rupee when it turns volatile.

A strong Forex kitty enables the RBI to intervene in the spot and forward currency markets by releasing more dollars to prevent the rupee from going into a free fall.

Conversely, a declining Forex kitty leaves the RBI less space to intervene in the market to prop up the rupee.

RBI Governor Shaktikanta Das had recently said that India’s external sector remains resilient and overall the central bank remains confident of meeting the country’s external financing requirements comfortably.

India’s Current Account Deficit (CAD) declined to $23.2 billion (0.7 per cent of GDP) during 2023-24 from $67.0 billion (2.0 per cent of GDP) during the previous year due to a lower merchandise trade deficit which reflects a robust external balance position, according to RBI data released on June 24 this year.

The RBI data also showed that India’s CAD recorded a surplus of $5.7 billion (0.6 per cent of GDP) in the January-March quarter (Q4) of 2023-24 as against a deficit of $8.7 billion (1.0 per cent of GDP) in the preceding October-December quarter of 2023-24.

–IANS

pannu/rad

Sci/tech

Indigo’s net profit drops 11.7 pc to Rs 2,728 cr in Q1, revenue up 17.3 pc

Mumbai, July 26 (IANS) Leading low-cost airline Indigo on Friday reported net profit at Rs 2,728 crore for the April-June quarter — a drop of 11.7 per cent from Rs 3,090.6 crore in the same quarter last year.

The operational revenue of the airline went up 17.3 per cent to Rs 19,570.7 crore in Q1 FY25, as compared to Rs 16,683.1 crore in the same quarter the previous year.

The shares of Interglobe Aviation Ltd, the parent company of IndiGo, closed 1.37 per cent up at Rs 4,491.25 on Friday.

“We saw a continued growth in total income of 18 per cent as compared to the same period last year to Rs 202.5 billion and a net profit of Rs 27.3 billion, resulting in a solid margin of around 14 per cent,” said Pieter Elbers, CEO.

Total expenses for the quarter were Rs 17,444.9 crore, an increase of 24 per cent over the same quarter last year.

“In a few days, we will celebrate our 18th anniversary wherein we will unveil our recently announced new initiatives to address the evolving market developments and our customers’ feedback,” Elbers added.

The air carrier currently has a fleet of 382 aircraft — a net increase of 15 passenger aircraft during the quarter.

IndiGo said it operated at a peak of 2,029 daily flights during the quarter including non-scheduled flights, and provided scheduled services to 88 domestic destinations and 30 international destinations.

The company has a total cash balance of Rs 36,100 crore comprising Rs 22,087 crore of free cash (as of June 30).

–IANS

na/rad

Sci/tech

DGFT tweaks Export Promotion Capital Goods scheme to help exporters

New Delhi, July 26 (IANS) The Directorate General of Foreign Trade (DGFT) has announced significant enhancements to the Export Promotion Capital Goods (EPCG) Scheme aimed at simplifying processes, reducing transaction costs, and promoting automation to benefit exporters.

The scheme has been tweaked to provide exporters an extended period to submit Installation Certificates for imported Capital Goods.

This extension reduces pressure on businesses, allowing them to focus more on production and export activities. Further, a simplified and reduced composition fee structure for extending the Export Obligation (EO) period has been introduced. This change minimises manual intervention, streamlines compliance and speeds up service delivery.

Also, from now all Policy Relaxation Committee (PRC) decisions regarding Export Obligation extensions and regularisation of exports will be implemented with a levy of a uniform composition fee making it easier to implement through the system.

“These updates make it easier for exporters to comply with regulations, reducing the time and effort required to meet DGFT requirements. By expanding automated rule-based processes, DGFT aims to reduce human intervention, mitigate risks and improve overall efficiency in trade facilitation,” the Commerce Ministry said on Friday.

“These changes align with the commitment of the government to create a more business-friendly environment and improve India’s manufacturing competitiveness,” an official statement said.

Since the announcement of the new Foreign Trade Policy in April 2023, DGFT has been actively modernising its systems to expand automated rule-based processes. These initiatives are crucial steps towards fostering a more business-friendly environment and enhancing India’s competitiveness in the global market, the statement added.

–IANS

sps/vd

Sci/tech

Gen X emulates millennials', Gen Z's spending on travel, F&B and services

New Delhi, July 26 (IANS) An increasing number of Gen X customers, those in the age group of 41-60 years, are spending more online on travel, food and beverages (F&B) and services categories like millennials’ and Gen Z, according to a report on Friday.

The report by fintech startup Simpl, showed the Gen X customers showed the fastest growth in spending in the first six months of 2024.

While spending on travel grew 72 per cent, F&B and services recorded 60 per cent and 57 per cent growth respectively.

This shift in consumer behaviour is primarily attributed to the growing number of services going online providing ease, convenience, and affordability in addition to customers getting habituated to smartphones via simpler app experiences, said the report.

“The Indian e-commerce industry is witnessing tectonic shifts where customers in the age group of 41-60 years have pipped 18-25 year olds in the growth in online spending,” said Puneet Singh, CXO- Business, Simpl.

“Interestingly, Gen X and Boomers also saw a 52 per cent increase in the frequency of transactions in the first six months of 2024 as against the same period last year. These shifts are driven by greater sets of services available online along with customers’ innate behaviour to seek affordability and convenience online,” he added.

The surge in the adoption of e-commerce services is also leading to a significant increase in the average order value (AOV) across categories.

While the AOV for health and fitness grew by 42 per cent to Rs. 1,022 from Rs 720, travel and marketplace AOV grew by 38 per cent and 35 per cent respectively.

Interestingly, the AOV of Boomers and Gen X is 20 per cent higher than that of Gen Z, in a testament to the growing trust and usability of internet commerce among seniors, the report said.

–IANS

rvt/svn

-

Video1 year ago

PM Modi Attacks Congress in Karnataka with “Kerala Story”

-

Cricket1 year ago

CSK players rejoice 5th IPL title with their families (Pics)

-

Politics1 year ago

Siddaramaiah & DK Shivakumar sworn in as Chief Minister & Deputy CM respectively

-

Entertainment1 year ago

Karan Deol weds his longtime Girlfriend Drisha Acharya (Pics)

-

Entertainment1 year ago

Urvashi Rautela dazzles on Cannes 2023 red carpet (Pics)

-

Entertainment1 year ago

Sunny Leone gets ready for Kennedy premiere in Cannes (Pics)

-

Entertainment1 year ago

Alia Bhatt looks crazy beautiful in Prabal Gurung creation at MET GALA 2023 (Pics)

-

Sports6 years ago

History Of Official FIFA WORLD CUP Match balls